In today’s digital landscape, financial services organizations manage a vast array of IT assets—from branch desktops and ATMs to mobile devices and specialized trading terminals. For large financial institutions, having accurate, real-time asset data is essential not only for operational efficiency but also for strengthening security and meeting regulatory compliance. By integrating asset data directly into ServiceNow, financial services can streamline asset management processes, improve incident response, and prepare for the future with AI-driven automation.

The Diverse Asset Landscape in Financial Services

Large financial institutions operate in a highly dynamic environment where assets span multiple locations and systems. Key asset categories include:

- Branch and ATM Networks: Traditional endpoints such as desktops, laptops, and servers coexist with specialized ATMs and kiosks. Each of these devices faces unique network conditions and physical security challenges.

- Mobile and Remote Devices: Employees rely on mobile devices and laptops for secure communications and transaction processing, while IoT sensors monitor physical security and environmental conditions in branches and data centers.

- Trading and Transaction Systems: High-performance workstations and dedicated trading terminals require stringent uptime and precision, making real-time asset data a necessity.

This diverse asset landscape makes it crucial to have a centralized view of asset data, ensuring every endpoint is monitored and maintained according to the organization’s high operational standards.

Overcoming Data Integration Challenges

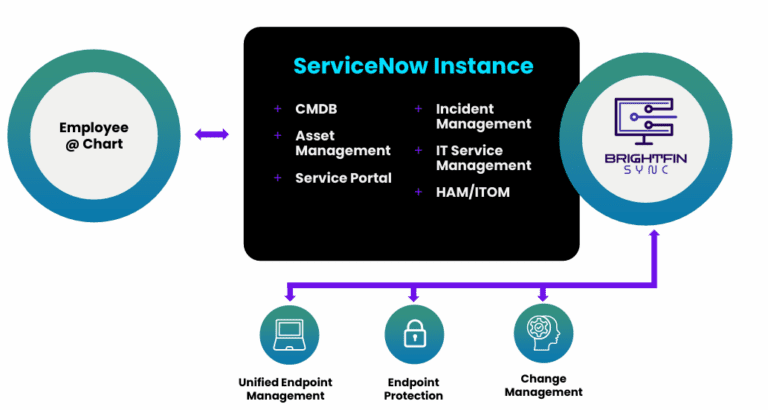

Fragmented asset data can lead to significant operational inefficiencies. In many financial institutions, asset data is captured by Unified Endpoint Management (UEM) systems yet often exists in silos, disconnected from core IT Service Management (ITSM) tools like ServiceNow. This disconnect can result in:

- Inefficient Incident Management: Delays in identifying and addressing device issues can lead to downtime in critical financial services.

- Operational Disruptions: Inaccurate asset records may trigger unnecessary maintenance or prevent timely updates, affecting overall system performance.

- Compliance Risks: Disparate data complicates audit trails and compliance reporting, which are vital for meeting stringent regulatory standards such as PCI DSS and FFIEC guidelines.

Integrating UEM data into ServiceNow’s centralized CMDB provides a single source of truth that helps financial institutions maintain accurate, real-time asset data. This integration bridges the gap between diverse endpoints and the ITSM workflows essential for rapid incident response and efficient change management.

Enhancing Security and Compliance

Security is paramount in financial services. With the increasing sophistication of cyber threats, every connected asset represents a potential vulnerability. Accurate asset data is critical to:

- Vulnerability Management: Ensuring that all devices—whether modern endpoints or retrofitted legacy systems—are updated with the latest security patches.

- Regulatory Compliance: Maintaining comprehensive audit trails and accurate documentation to satisfy regulatory requirements and mitigate risks.

- Operational Integrity: Preventing unauthorized access and safeguarding sensitive financial data by monitoring the health and status of all endpoints in real time.

By feeding accurate asset data into ServiceNow, financial institutions can automate workflows that trigger rapid remediation actions, thereby strengthening their overall security posture and ensuring that all compliance mandates are met.

Driving Operational Excellence with Real-Time Asset Data

For financial services, operational continuity is non-negotiable. Real-time asset data empowers IT teams to:

- Minimize Downtime: Proactively identify issues through predictive maintenance, reducing unplanned outages that could impact critical services.

- Enhance Incident Response: Leverage automated alerts and workflow triggers in ServiceNow to quickly resolve problems before they escalate.

- Streamline IT Operations: Automate routine tasks and reduce manual interventions, freeing up resources to focus on strategic initiatives.

When asset data is reliable and up-to-date, financial institutions can optimize their IT operations, ensuring seamless service delivery across global branch networks and digital platforms.

Preparing for the Future with AI-Driven Automation

As financial services organizations continue to evolve, the integration of AI-driven solutions into IT operations is becoming increasingly important. ServiceNow’s emerging agentic AI capabilities offer the promise of autonomous incident resolution and proactive maintenance. However, the success of these advanced tools depends entirely on the quality of the underlying asset data. Inaccurate or incomplete data can lead to misguided AI actions, potentially causing service disruptions or security breaches.

By ensuring that asset data is clean and seamlessly integrated into ServiceNow, financial institutions can confidently leverage AI to drive:

- Predictive Analytics: Anticipating device failures and scheduling maintenance before issues arise.

- Intelligent Incident Resolution: Automatically triaging and resolving incidents with minimal human intervention.

- Dynamic Asset Optimization: Continuously adjusting and fine-tuning asset performance based on real-time data.

This future-ready approach not only enhances operational efficiency but also sets the stage for a more agile, resilient IT infrastructure within the financial services sector.

Conclusion

Effective asset management is the backbone of secure and efficient financial services operations. For large financial institutions, integrating comprehensive asset data from UEM systems into ServiceNow is critical to maintaining operational continuity, ensuring regulatory compliance, and preparing for the future of AI-driven automation. By embracing a centralized, real-time view of all endpoints, financial organizations can streamline IT service management and secure their competitive edge in an increasingly digital world.